The US election was, as many predicted, a hard-fought election. Although the coronavirus pandemic was a key issue for both sides, the election was characterised by the overt populist support that Trump enjoyed and played out through his large rallies, and the more mainstream support for Biden.

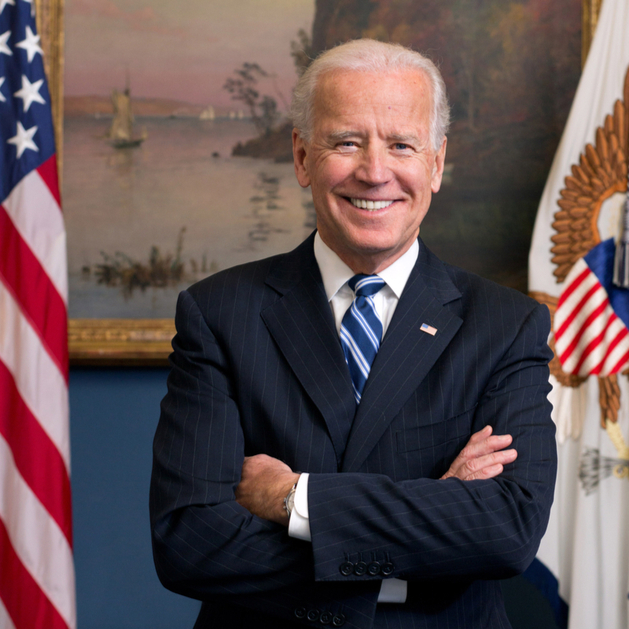

Although the result of the election has not been formally announced and President Trump has not yet formally conceded, we now expect Joe Biden to be the next incumbent of the White House after January 20th, 2021.

Across a huge range of issues, the Biden presidency will be in marked contrast to the Trump administration. However, the so-called Democrat “Blue Wave” failed to materialise, meaning that the Senate will still be under Republican control, meaning that many proposed policy changes will be more tempered. This could be positive from the perspective of financial markets.

Financial markets prefer stability and certainty and often react unfavourably to dramatic changes, so the potential gridlock between a Democratic White House and a Republican-controlled Senate could well curb large policy changes, particularly those around areas such as tax reform. We expect a more centrist US, providing a more stable platform for economic growth and recovery.

Of critical importance in the US will be the details of any stimulus package to support the economy. Many economists predict that the scale of economic stimulus could be reduced due to influence from Republicans in the Senate. However, perversely, this may actually provide a boost to prospect for financial markets because a smaller stimulus package will create a greater need for support from the Federal Reserve. This will mean that interest rates will remain at their current historic lows for an extended period and may even see the scale of quantitative easing maintained for longer, or even increased.

Overall, our expectation is that there are good prospects for stock market growth heading into 2021.

From a UK perspective, the likely change in the presidency also has the potential to have significant impacts. Biden, in contrast to Trump, appears to be far more of a globalist in his geopolitical outlook and favours international co-operation and the support of multinational bodies in contrast to Trump’s more nationalistic approach. However, Biden has already voiced concerns over Brexit and has specifically expressed disappointment that UK trade proposals could potentially break international law.

Irrespective of the finer details of Britain’s departure from the EU; the US and the UK will almost certainly continue to enjoy a strong relationship that is likely to support British trade as well as a UK standing in the world.

In summary, we are hopeful of a transition into a more stable centrist geopolitical scenario following the tumultuous events of 2020. Whilst predicting financial markets is incredibly difficult at the best of times, we have expectations of stock market growth heading into 2021. We expect there to be contrasting performance between different sectors of the economy, but this will mean significant opportunities for investors, making strong asset allocation and portfolio diversification more important than ever.

At Foresight Wealth Strategists we are watching these trends carefully and are speaking to a wide number of analysts and economists in order to position our clients in the best possible position.

If you would like to discuss any aspect of your investment portfolio then please contact us to arrange a portfolio consultation with one of Wealth Strategists.

Author

-

Foresight Wealth Strategists have been providing extensive financial planning advice to Hale and the surrounding areas for 25 years - info@foresightws.co.uk

View all posts