Library.

How can a book or a small habit change transform your life?

Ever thought about how a book or a simple change in your habits can spark massive growth in your life? In the journey of life, the pursuit of personal development and growth stands as a beacon, guiding us towards our fullest potential. It’s a commitment to continuous learning, embracing change, and cultivating a growth mindset…

Read articleFeel overwhelmed by investment options?

Do you understand the investment options that are on offer? Do you feel overwhelmed and uncertain of their meaning? Let’s make it simple: Strategic Asset Allocation – diversifying your investments across different asset classes such as stocks, bonds, property, and even cash to spread your risk – accounts for about 80% of investment performance – meaning…

Read articleYorkshire 3 peak Challenge Completed

On Saturday, October 5th, the following members of the Foresight team – Daniel Willoughby, Damienne Mitchell, Ben Dyson, Thomas Filby, Alex Youngs. Greg Blease and Callum Kingsley-Rivans, completed the Yorkshire 3-Peak challenge. Living in another County meant an early start of 4:45 am. Arriving at 6:20 am, at Horton-in-Ribbleside designated car park to the sight…

Read articleCase Study: Estate planning – BPR/Trusts/Wills

Glenda was recommended to Foresight by a friend following the death of her husband. Her husband had recently died and she knew that, on her subsequent death, the children would be left with a significant Inheritance Tax liability. Glenda also had concerns about protecting the wealth she would be passing on, due in part to…

Read articleTransform Your Financial Destiny: Empowerment Through Education

In a world full of opportunities, mastering your finances goes beyond the numbers; it’s about empowering you to make wise, informed decisions. With Foresight Wealth Strategists, it’s not just about planning; it’s about tailoring a strategy that aligns with your aspirations, leveraging our bespoke Quantum Programme for a personalised journey. Here’s how to take the…

Read articleInvesting with Purpose

The choices we make today define the world we live in tomorrow. The concept of sustainable and ethical investing has emerged not just as an option but as a critical consideration for forward-thinking individuals. Here’s why: Impactful Investing: The power to foster change lies within our portfolios. Aligning investments with our core values, we contribute…

Read articleThe Three Peaks Challenge

Mark Hughes – Foresight’s Head of Operations – was recently diagnosed with tongue cancer. The cancer appeared one week and was so aggressive that it resulted in Mark being fast-tracked through our wonderful NHS system which enabled him to be treated within 4 weeks. A 10-hour operation followed, and he is now going through…

Read articleFinancial Planning Across Life’s Stages: Wealth Strategy Tips for the UK

Effective financial planning is crucial throughout life’s various stages, from starting a career to planning for retirement and beyond. This guide explores the unique financial needs at each life milestone for you, providing tailored advice to ensure financial stability and growth. Starting a Career: Building a Financial Base: Begin with solid budgeting practices, save diligently,…

Read articleMastering Change with The Quantum Programme

Bespoke Wealth Management for Every Stage of Your Life In an era where financial landscapes are perpetually shifting, The Quantum Programme from Foresight Wealth Strategists offers a pioneering approach to wealth management. This bespoke process is designed to adapt and evolve, perfectly aligning with your personal and financial aspirations at every stage of life. The…

Read articleLearn To Enjoy Your Money

As a Wealth Strategist, one of the things that you learn at a very early point is that it is not theamount of money you have that makes you happy, it’s what you do with it that gives the enjoyment.And, although the richest clients are not necessarily the happiest, it is also true to say…

Read articleAre Get Rich Schemes Worth It?

With many of the major indices fluctuating and some disposable income to spare, people have beenlooking at alternative ways to make money. Many have gravitated towards cryptocurrencies, mostparticularly Bitcoin, although a plethora of these currencies have been created over the past fewyears. With the rise of social media in recent years, it is impossible to…

Read articleAvoid Pitfalls When Making Financial Gifts

Making a gift to your family and friends while you are alive can be a good way to reduce the value ofyour estate for Inheritance Tax purposes, ensuring those closest to you benefit from a lifetime ofyour hard work. Estate and tax planning is a complex area and professional financial advice can helpyou avoid several…

Read articleWelcome to Damiene

Join us in welcoming Damiene Mitchell to the Client Manager Team. Damiene has a background in financial services administration and is delighted to have a new role where his technical knowledge will be expanded under the guidance of Foresight. Outside of work, Damiene loves sports but being originally from Johannesburg, South Africa, his passion…

Read articleWelcome to Dan!

We’re thrilled to announce that Dan Willoughby has joined the Foresight Wealth Strategists team as our new Client Manager. With his extensive background in financial services and a particular passion for estate planning, Dan is perfectly positioned to support our clients in navigating their financial journeys. Outside the office, Dan is an avid basketball…

Read articleForesight Wealth Strategists Bank Holiday.

Foresight Wealth Strategists Bank Holiday. We’re pleased to announce our very own Foresight Bank Holiday on July 12th. This unique day is dedicated to celebrating our team’s hard work and commitment. It’s a time for us to unwind, recharge, and enjoy some well-deserved rest. As we take this day to reflect on our achievements, we…

Read articleMark Hughes helps to raise over £8,000 for local charity

On the 13th July 2016 tragically Dave Holman lost his life in a road traffic accident he was only 38 he was a loving son, brother, Uncle and great friend to many and is missed beyond measure. Every year since Dave passed away his friends have organised what has become “The Dave Holman Challenge” raising much…

Read articleHow Safe Is Your Final Salary Pension?

Services provider Carillion has found itself joining the likes of Toys ‘R’ Us and BHS, in becoming the latest company to self-destruct. Leaving a devastating effect on defined benefit (DB) pension savers. The Carillion disaster happened just as the Pension Protection Fund (PPF) reported that roughly two-thirds of the DB pension schemes in operation in…

Read articleMastering Financial Planning Techniques with Foresight: Your Path to Empowerment

Navigating the complexities of personal finance requires more than just saving for a rainy day; it demands a comprehensive understanding and application of financial planning techniques. At Foresight Wealth Strategists, we’re dedicated to empowering individuals through education and strategic planning, ensuring your financial goals aren’t just dreams but achievable realities. This article explores essential financial…

Read articleSpring Budget 2024

The Chancellor delivered the last Spring budget of this on 6th March. In his speech, Jeremy Hunt said he was setting out to reward hardworking families with National Insurance tax cuts – leaving the average worker over £900 better off. However, it remains to be seen as to whether the tax cuts have moved Tory sentiment in…

Read articleKey Dates in March

Pension Credit, which averages over £3,900 a year, is there to lend a hand with day-to-day expenses for those who have reached state pension age and are on a low income. About 1.4m people are already receiving Pension Credit, but an estimated 880,000 eligible households are yet to claim it. In the Spring Budget,…

Read articleVacancy – Receptionist/Admin person

Up to £25K pa, depending on experience. Foresight Wealth Strategists has an exciting opportunity for a Receptionist/Admin person to join our growing team. As one of the leading financial planning practices in the North-West, we are looking for someone who will be able to provide our clients with an unrivalled front of house customer experience. Our clients are…

Read articleChildren Should Be Saving For Themselves

Children are expensive! The cost of raising a child from birth to their 18th birthday currently stands at nearly £250,000. Their wants and needs are satisfied more inexpensively when young – although childcare is becoming an ever-increasing burden. But when they get to their late teens and early twenties those ‘must-haves’ – the first car,…

Read articleTax doesn’t need to be Taxing

The UK Government is forecast to take a total of £950bn in tax this year, approximately 36.9% of Gross Domestic Product (GDP), which makes this the highest tax burden the UK has faced since just after the Second World War. Tax is important as it helps pay for services such as schools, the NHS, and…

Read articleRecommended Internet Provider

Foresight has been using Zen Internet for our internet connection for over 20 years. I have always been a fan of Zen, based in Rochdale, which are the only internet provider that has remained in business since 1995. They offer an amazing product, excellent and knowledgeable service, and at a competitive price. Not the cheapest,…

Read articleGet to know: Josh Lenihan, Senior Wealth Strategist

We believe that our team members are what sets us apart from other businesses. Join us as we sit down with Josh, to talk about his day-to-day life at Foresight, and what he gets up to when he’s not in the office. Tell us a bit about yourself Throughout my time in education, I was…

Read articleConsidering Animals and Pets in your Will

We all want the best for our pets and animals during our lifetime, but consideration also needs to be given to what happens beyond this. This is important from an animal welfare point of view, but also from an estate planning perspective as well. Pets are considered ‘personal chattel’, meaning that the changing ‘ownership’ of…

Read articleSolidus Achievement of Excellence for Estate Planning 2023

We are delighted to announce that we have once again been awarded the Solidus Achievement of Excellence for our Estate Planning and Trust based solutions. Solidus is a leading Estate Practitioner and has now been the preferred provider of Trusts and estate planning solutions for Foresight clients for over 10 years. At Foresight, our aim…

Read articleGet to know Mike Barnes

Our team members are one of the main factors that sets us apart from other businesses. Join us as we sit down with Mike to talk about his day-to-day life at Foresight, and what he gets up to when he’s not in the office. Tell us a bit about yourself All through school and…

Read articleVacancy – IFA Administrator

Location – Richmond House, Hale, UK Salary – £22,000 -£30,000 (DOE) Due to continued expansion, we are delighted to announce that we are looking to recruit an IFA Administrator to join our dynamic and forward-thinking team. Our ambitious plans can only be achieved by recruiting the right people. We provide an excellent on the job…

Read articleA week in the life of…Work Experience

After arriving at the office, I was warmly greeted by Clair Davis, Receptionist, before being taken on a quick tour, followed by a briefing on how to use the various facilities and a health and safety induction. Later that day, I met with one of the Client Managers, Ben Holland, who told me about his…

Read articleA week in the life of…Work Experience

In August 2023 we welcomed Theo into the offices to do a week of work experience with us. He spent the week shadowing various people around the business and learning how day-to-day life is in a busy office. Let’s see what he got up to while he was with us… Embarking on my week of…

Read articleForesight Shortlisted for Money Marketing Awards 2023

We are thrilled to announce that we have been shortlisted for two awards in the 2023 Money Marketing Awards. Josh Lenihan has been shortlisted for Financial Adviser 2B – for future generation advisers, and we have also been shortlisted for our Quantum Academy as the Best Adviser Academy. This is great confirmation of the importance…

Read articleCan I stop my spouse sharing my inheritance on divorce?

A party to a marriage or civil partnership may understandably want to know whether their spouse would be awarded a share of assets they have inherited if they ever divorce, and what they could do to reduce the chance of this happening. Firstly, there is a general principle even where short marriage or civil partnerships…

Read article2023 Budget Announcement

The aims of the Chancellor in this year’s Spring Budget were to get people into work and keep them there, with key changes to childcare and pensions. The Office for Budget Responsibility (OBR) stated that the UK will not enter a technical recession and inflation will more than halve and reduce to 2.9% by the…

Read articleProfessional Advisor Nominations

We are delighted to announce that this year we have been shortlisted by Professional Adviser again, this time not for one but three awards! At Foresight, we pride ourselves on excellence and are committed to providing the best advice and a great experience for our clients, whilst also supporting our team members through their careers. …

Read articleWebinar: When is the best time to sell my business?

Hosted by Simon Booth, CEO of Foresight, and Paul Dodgshon, Managing Director of Uscita. This webinar is specifically aimed at business owners who might be looking to sell their companies at some point in the future. You may not be looking to sell right now, however, this webinar will highlight just how much work needs to be…

Read articleISA deadlines for 2023

Using Individual Savings Accounts (ISA) has always been a very tax-efficient way of investing, with no liability to either income tax, or Capital Gains Tax on the invested funds. These days ISAs offer the opportunity for every individual to invest up to £20,000 per annum. Unlike pension allowances, ISA allowances cannot be reclaimed from previous…

Read articleVacancy – Client Manager

Location – Richmond House, Hale, UK Salary – £22,000-£45,000 (dependant on experience and qualifications) Who are we… Foresight Wealth Strategists are an award-winning financial planning practice, based in the centre of Hale, near Altrincham. Since 1998, we have been specialising in providing high-quality financial planning advice to business owners, professionals, and high net worth individuals.…

Read articleGovernment Plans to Shake Up ISAs – What It Could Mean for Your Savings

The UK government is looking at big changes to how ISAs work, and the main target is the £20,000 you’re currently allowed to save tax-free each year. Right now, that allowance can be spread across either cash ISAs or investment ISAs, or a mix of both. But ministers are now seriously considering capping the amount…

Read articleThe Curious Case of the Vanishing Non-Doms: New Rules of Residency

Non-dom status, or Non-Domicile Status to give its’ full title – is the status which many dream of, few pursue and even fewer achieve. Non-dom describes a UK resident whose permanent home, or domicile, for tax purposes is outside the UK. It refers to a person’s tax status, and has nothing to do with their…

Read articlePremium Bonds: A Safe Bet or Just a Bit of Fun?

If you’re looking for a low-risk way to save money – with a bit of excitement thrown in – Premium Bonds might sound like a winner. They’ve been around since 1956 and are still one of the UK’s most popular savings products. But are they really a good investment, or just a government-endorsed lottery in…

Read articleWhats the single best decision when starting a wealth strategy?

Whenever I’m asked what the single best decision is when starting a wealth strategy, my answer is always the same. Clarity. Before you start thinking about investments, savings, or retirement planning, you need to understand why you’re doing it in the first place. – What kind of lifestyle are you working towards?– What does it…

Read articleTeam Spotlight: Ben Dyson – Award Winning

At Foresight, we’re proud to celebrate the achievements of our team and this year, Ben Dyson has certainly given us something to celebrate. Ben has been recognised as the United Kingdom’s Wills and Trusts Adviser of the Year for both 2023 and 2024 in the prestigious Finance Monthly Global Awards. Being honoured once is an…

Read articleUnderstanding what wealth means to you

Over the years, I’ve had hundreds of conversations with people about their finances and I’ve come to realise that wealth means very different things to different people. For some, it’s about freedom: the ability to choose how you spend your time, where you live, and who you spend your days with. For others, it’s about…

Read articleWhen should you start thinking about a financial legacy?

The short answer? Sooner than you think. Legacy isn’t just something you consider later in life, it’s the result of years of planning, intention, and consistent action. Whether it’s protecting family wealth, supporting causes close to your heart, or setting the next generation up for success, the decisions you make today shape what you leave…

Read articleWhy Having a Valid Will Matters

The recent news of Liam Payne’s untimely death and the complications surrounding his £24 million estate serves as a powerful reminder of the importance of having a valid Will in place—regardless of age or perceived invincibility. The former One Direction singer tragically died at just 31 years old, leaving behind significant assets including money, property,…

Read articleCompounding: The Quiet Force Behind Long-Term Wealth

Compound interest has been described as the eighth wonder of the world. Understanding its effects is essential to success in investment, yet it remains a mystery for many people. We are talking about returns where the gains are added to the capital sum, to which each successive period’s rate of return is applied. The…

Read articleWills Aren’t Just for the Elderly

“I’ll sort that when I’m older.” If we had a pound for every time we’d heard that about Wills, we’d be rather wealthy by now. The truth? Wills aren’t just for the elderly—they’re for anyone who wants peace of mind about the future. As the pandemic starkly reminded us, life is unpredictable. And without a…

Read articleWhat Do Virtual Reality Headsets, Pulled Pork, and Slider Sandals Tell Us About the Economy?

Each year, the Office for National Statistics (ONS) updates its “basket of goods and services”—the list of items used to calculate the Consumer Price Index (CPI), which helps measure UK inflation. It’s more than just a list of prices; it’s a snapshot of how our spending habits are evolving and what matters to us as…

Read articleThe Psychology of Money: How Emotional Biases Interfere with Rational Investing.

When making financial decisions, we often like to believe that we are guided solely by logic, analysis, and numbers. However, the truth is that our emotions play a significant role in how we manage and invest our money. Emotional biases are ingrained in the psychology of investors and can be very hard to overcome. …

Read articleProper Financial Planning

Every year, in the run-up to and after the tax year-end, you see article after article telling you about your tax allowances and how to use them. And if you have already got a financial adviser, the chances are you are already aware of this and your adviser should be taking advantage of these allowances…

Read articlePlanning Your Business Exit Strategy: What’s Right for You?

Every business owner will eventually face the question: How will I exit my business, and what will I walk away with? Whether you run a small, owner-managed enterprise or a growing company, having an exit strategy in place ensures a smoother transition and helps you maximise your financial return. Why Plan Your Exit Early? An…

Read articleWhy Every Business Needs a Shareholder Agreement

When starting a business, optimism, and enthusiasm often take centre stage. Partners embark on their venture with trust and shared vision, rarely considering what might happen if circumstances change. However, as businesses evolve, a dose of realism is essential—especially when it comes to protecting the future of the company and its shareholders. A Shareholder Agreement…

Read articleWhat Drives a Successful Entrepreneur?

Entrepreneur noun 1. A person who sets up a business or businesses, taking on financial risks in the hope of profit. Starting a business is often the ultimate dream—breaking free from the constraints of employment, taking control, and building something your own. But what truly drives an entrepreneur? The Motivation to Succeed Entrepreneurs come from…

Read articleWelcoming Sharon to the Foresight Team

At Foresight, we believe that every member of our team plays a vital role in shaping our client experience. With that in mind, we’re delighted to introduce Sharon, who joins us as our new Receptionist. Bringing over 37 years of administrative experience, including 17 years in Public Relations, Sharon is no stranger to building strong…

Read articleProtecting Your Inheritance in the Event of Divorce

When you inherit wealth, it’s natural to want to keep it within your family, especially if your marriage or civil partnership comes to an end. But can you prevent your spouse from claiming a share of your inheritance in a divorce settlement? The answer depends on various factors, including how the inheritance is used, the…

Read articleAre You on Track for a Comfortable Retirement?

When it comes to retirement planning, how do you compare to the national average? According to the Pensions and Lifetime Savings Association (PLSA), a couple needs a net income of £30,600 per year (£36,200 in London) to enjoy a moderate standard of living in retirement. Yet, research suggests that only 42% of UK households are…

Read articleWhen Wills Go Wrong: How to Avoid Family Disputes

The days of straightforward inheritance planning are long gone. With more people experiencing multiple marriages, blended families, and step-relatives, estate planning has become significantly more complex. What once seemed simple, leaving everything to your children, now requires careful thought to avoid unintended disputes and legal battles. The Risk of an Outdated Will Many assume that…

Read articleWills with a Twist: Strange and Surprising Bequests

When it comes to estate planning, most people focus on securing their loved ones’ futures, ensuring assets are distributed fairly, and minimising tax implications. However, history has given us some truly bizarre and eccentric wills, proving that some individuals use their final wishes to make a lasting (and often peculiar) impression. Here are some of…

Read articleMaximise Your ISA Allowance Before the Tax Year Ends

Individual Savings Accounts (ISAs) have been a staple of tax-efficient investing for over two decades. Offering tax-free growth and withdrawals, ISAs allow individuals to invest up to £20,000 per tax year, making them an essential part of a well-rounded financial plan. Use It or Lose It Unlike pension allowances, ISA allowances do not roll over.…

Read articleWhy your children should save for themselves!

Children are expensive, with research showing that the average child now costs nearly £250,000 from birth to their 18th birthday. Their wants and needs are satisfied more inexpensively when young. But when they get to their late teens and early twenties those ‘must-haves’ – the first car, the University education and even a deposit on…

Read articleEnhancing Wellbeing with the Oura Ring

In today’s fast-paced world, prioritising health and wellbeing has never been more important. For those seeking a comprehensive yet convenient way to monitor and improve their wellness, the Oura Ring offers a cutting-edge solution. Combining sleek design with advanced technology, this smart ring has become a trusted tool for health-conscious individuals worldwide. What is the…

Read articleHow Technology is Revolutionising Wealth Management: The Role of AI and Blockchain

The integration of technology into finance is transforming the way we manage wealth. These days, we use our phones to run our finances – everything from purchases to signing off accounts using digital signatures. AI – Artificial Intelligence – is only going to enhance these capabilities, providing data-driven personalised strategies and real-time analytics which will…

Read articleWelcome to Holly

We welcome Holly to the Foresight team as a Financial Administrator. Holly has worked in the financial planning industry for several years and comes complete with a methodical and organised approach to her work. Holly has a keen interest in social media from a previous career and will be posting team news on Instagram Outside…

Read articlePass Go This Christmas: Family Fun with Monopoly and More

Christmas is a time for family, laughter, and a little healthy competition. For many households, no holiday season is complete without a good old-fashioned game of Monopoly. Whether you’re building your property empire, dodging bankruptcy, or charging rent to unsuspecting relatives, Monopoly brings the thrill of strategy and the occasional festive rivalry. But let’s be…

Read articleCase Study: From IPO to Independence

Robert was introduced to Foresight by an existing client, who had previously sold his business for a significant amount. Robert was working at a tech company that grew very quickly to a point where they had an Initial Public Offering (IPO. Robert ended up with a large shareholding and wanted to find out what his…

Read articleSimple change in your habits can spark massive growth in your life?

Ever thought about how a book or a simple change in your habits can spark massive growth in your life? In the journey of life, the pursuit of personal development and growth stands as a beacon, guiding us towards our fullest potential. It’s a commitment to continuous learning, embracing change, and cultivating a growth mindset…

Read articleWelcome to Thomas

We are delighted to welcome Thomas as a Client Manager who has joined us after working as a Paraplanner for another financial adviser. He has a Finance and Banking Degree from Sheffield Hallam and is another United supporter in the office – a Peterborough United fan. Keeping fit is important to Thomas and is a…

Read articleCase Study: John and Linda’s Financial Success Story

John and Linda were initially introduced to after responding to a telesales campaign over 20 years ago. They had an existing financial adviser through their accountant, who had put in place a number of products over a period of time. However, there was no overall strategy in the client’s financial planning. As a result,…

Read articleTorn Will triggers £800k family dispute

The family of 92-year-old Carry Keats is facing an £800,000 court dispute after she partially tore up her Will shortly before passing. Keats, who owned property and land in Wiltshire, tore up most of her Will on her deathbed, leaving her estate’s future uncertain. Here’s what’s at stake: If the court decides Keats’s actions legally…

Read articleHappy Steaming!

It’s that time of the year where we need to heat our homes to keep warm. However, in doing this, we also dry the air around us. It is a well-known fact that dry enclosed air isn’t a great environment to live in. For many years I have used steam diffusers both at home and…

Read articleCase study: Simplifying estate after death

Samantha became a client of Foresight after attending one of our estate planning events. Her mother had recently passed away and she was not confident about what to do. The mother had collected a significant number of banking and investment accounts through her lifetime and, as sole executor and beneficiary, it now fell on Samantha…

Read articleAligning Your Investments with Your Values: A Guide to Ethical Investing

In today’s investment landscape, aligning portfolios with personal values isn’t just possible—it’s becoming a priority for many. At Foresight Wealth Strategists, we recognise the increasing importance of sustainable and ethical investing. This guide explores how you, as an investor, can make choices that not only yield financial returns but also contribute positively to the planet…

Read articleWelcome to the team Charles Truswell

Join us in welcoming Charles to the Team! Charles joins us as a Client Manager, with a background in financial services in administration, he’s delighted to have a role where he can expand his technical knowledge under the guidance of our team. Outside of work he enjoys all sports, particularly cycling or grappling, whether watching…

Read articleWelcome to the team Greg Blease

Greg has recently joined us as a Wealth Strategist, having advised clients for a couple of years in his previous role. Greg is Diploma qualified and close to completing the work to become Chartered, he prides himself on producing the best possible outcomes for clients and delivering an exceptional client experience. Outside of work Greg…

Read articleWebinar: What can I do now to plan for my future?

Hosted by Simon Booth, CEO of Foresight, and Joshua Lenihan, Senior Wealth Strategist at Foresight. This webinar is aimed at anyone, of any age who is looking for advice on how to plan better for their future. It’s never too early, or too late to start preparing for your future. You can watch the full…

Read articleAnother Chartered Financial Planner in the Foresight Ranks

Fantastic news! We are delighted to announce that Josh Lenihan has been awarded both his Chartered and Fellowship status with the Chartered Insurance Institute. This is the pinnacle of the financial planning profession, which very few planners ever achieve. Better than that, Josh is almost certainly the youngest recipient of these qualifications in the country…

Read articleYou don’t need to say I do

Most people know that Inheritance Tax (IHT) payable on death at a rate of 40% on assets in excess of the £325,000 per person Nil Rate Band (NRB). Nowhere near as many realise that unmarried couples cannot inherit their partners estate above this figure tax-free, no matter how long they have been living together. This means that,…

Read articleDiscover our brand new look

You may have heard over the past few months that we have been working hard on developing our branding, and building a new website? We’re pleased to say that we are now live! Have a look here… Our new brand and website reflects the evolution of Foresight Wealth Strategists, we are a modern and dynamic team…

Read articleIt’s our 25th Birthday today!

Today is the 25th anniversary of Foresight. Who would have thought that, on the 16th February 1998, we would have ended up where we are today? What a journey it has been! There have been incredible highs, some significantly lower points – but, overall, the best decision I ever made to start the company. We…

Read articleWelcome to Meg!

We are delighted to welcome Meg to the Foresight Team as our newest Client Manager. Meg is working towards her Diploma and brings a wealth of knowledge over with her from her previous roles. Meg is already settling in to the team and we look forward to supporting her through this next stage of her…

Read articleSolidus Achievement of Excellence for Estate Planning 2022

At Foresight, we always aim to provide the best service for our clients and work hard to maintain these standards. However, we’re always happy to be recognised for our efforts. We are delighted to announce that we have once again been awarded the Solidus Achievement of Excellent for our Estate Planning and Trust based solutions.…

Read articleUse those Tesco Clubcard Points!

More than two million Tesco customers could potentially lose out on a total of £13 million worth of Clubcard vouchers if they do not use them. The vouchers, first issued in December 2020, expire automatically after 2 years if not claimed, meaning that customers would lose out on the savings. The benefit of the vouchers…

Read articleInterest Rates on the Up!

The Bank of England has raised interest rates again – the 7th time this year and only 6 weeks after the previous rise – this time by 0.75 percentage points to 3%. Not so good for those with large mortgages, but the first time in well over a decade that interest rates for savers have…

Read articleThe Gender Saving Rate

Recent research has shown that men have £599 billion more in their ISAs, investment accounts and private pensions than women. This staggering figure equates to the Gross Domestic Product (GDP) of Switzerland. Other research by the consumer money website, Boring Money, found that 3.3 million fewer women hold investments in the UK compared with men…

Read articleHow does the weakness in Sterling affect me?

The pound slid to an all-time low against the dollar amid worries about the direction of the Government’s economic policy, following the much-derided mini-budget from the now ex-Chancellor of the Exchequer, Kwasi Kwarteng. Although the political situation has swiftly moved, the longer-term effects of a government prepared to unveil deep unfunded tax cuts with no…

Read articleIn Conversation with…Ben Dyson

In October 2022 Ben Dyson our Senior Wealth Strategist joined Kimberley Dondo on her In Conversation With… Podcast. They discussed a number of things, including how Ben got into a career in finance, and how he uses his knowledge to empower clients to be financially free listen to the entire podcast here. Author Foresight Foresight…

Read articleThe End of an Era

For most people, the period of financial excitement that came to a messy end in 2008 will always be the point of comparison for future recessions. For reference, I was still in education at this time, so largely sheltered from the worst of things. However, the ripple effects were still felt. Prior to ’08, university…

Read articleHow do you compare?

Industry experts, the Pensions and Lifetime Savings Association (PLSA) suggest that, to have a moderate standard of living in retirement, a couple needs a net income of around £30,600 a year or £36,200 for those living inside London. Yet only about 42% of UK households are on track to achieve this. They have done a…

Read articleKing Charles III will not pay any inheritance tax

King Charles III has avoided paying millions in inheritance tax on the Duchy of Lancaster estate due to an old rule designed to protect the Royal Family’s wealth. His Majesty automatically inherited the estate, worth over £652 million, following the death of his mother, Queen Elizabeth II. Under UK law, Inheritance Tax is levied at…

Read articleDo you know where all your pensions are?

When people move home, only around 1 in 25 remember to tell their pension providers their new address. This has led to over £19.4 billion of unclaimed pension pots, equating to 1.6 million pensions with an average fund size of £13,000. National Pension Tracing Day is on Sunday, 30th October, an unhelpful date as all…

Read articleInvesting in a zombie company

The Financial Times recently reported that the UK Future Fund, a government-run venture fund set up during the pandemic, has mostly invested in zombie businesses that have no long-term viability. This is not surprising given the apparent confusion over whether the fund was focused on growth or simply providing a backstop for high-risk businesses. The…

Read articleThe cost of education

A good education can be invaluable, but also requires significant investment and long-term planning. Last year the average cost for parents getting a child from birth to the age of 21 came in at £231,843, according to a recent study compiled by the Centre for Economics and Business Research in London. Although the total includes…

Read articleHow to avoid a pension scam

Pension scams are on the rise, with at least £2,241,774 reportedly lost to pension scammers in the 5 months between January and May 2021, the problem is getting bigger. Scammers try to persuade you to transfer your pension savings, or to release funds from it, by making attractive-sounding false promises that whilst sounding appealing have…

Read articleJoin us in welcoming Michael to the Foresight Team

We are delighted to welcome Michael to the team as our newest Wealth Strategist. Michael has been working in the Financial Services Industry for a number of years and is currently working towards becoming Chartered, alongside his numerous other qualifications. Michael is already settling into the team really well and we look forward to working…

Read articleJoin us in welcoming Damian to the Foresight Team

Damian has joined our team as our newest Client Manager, Damian has previously worked in the Financial Services industry at a compliance firm doing research and has transitioned into paraplanning. Damian is currently working towards his diploma in Regulated Financial Planning and in his spare time competes all over Europe in Buhurt (medieval armoured combat)…

Read articleIs £50k per year enough for your retirement?

It has been calculated that couples will need to find an extra £2,200 a year to maintain their standard of living post-pandemic, according to the pension’s industry research. The estimates show that a basic standard of living for a couple now costs £16,700 per annum, a moderate lifestyle requires £33,600 per annum, and a comfortable…

Read articleRevelations for Revolut

Back in 2008 we saw a number of banks collapse and others bailed out by the taxpayer. This highlighted that savers needed to make sure their money was protected if the worst ever happened again. Broadly speaking, bank savings are covered for up to £85,000 through the Financial Services Compensation Scheme (FSCS). The FSCS protects…

Read articleA week in the life of….Work Experience

In August 2022 we welcomed Harry to do a week of work experience with us, Harry has never worked in an office before and wanted to get an idea of what to expect before he heads off to university. Let’s see what he got up to while he was with us… For a college student…

Read articleSearch behind the sofa

People now have only 100 days left to use the paper £20 and £50 banknotes before they are no longer in circulation. The last day of legal tender status is 30th September 2022. People who still have them need to use them or deposit them at their bank or a Post Office before that date.…

Read articleState of the Nation for Quarter 2

Every quarter, we sit down together and discuss what has happened so far in the year, look at where we are in regard to our targets and what our focus is going to be for the next quarter. We have found doing this quarterly works particularly well, as it ensures the team are kept abreast…

Read article4 of our Client Managers gain Diploma Qualifications in 2022

As the end of the academic year arrives, it feels good to announce that the last of our Client Manager team has achieved their Diploma qualification. The financial planning profession is one of the most highly regulated, and anyone advising clients must hold a Level 4 qualification, usually the Diploma in Financial Planning from the…

Read articleMoney Marketing Awards 2022 – Nomination

We are really proud of every member of our team, they work really hard for our clients as well as on their own development, so you can imagine our elation when they receive recognition from the wider industry. Ben Dyson has been with us for 7 years and is our Senior Wealth Strategist, his passion…

Read articleIs HMRC the major beneficiary of your estate?

The latest HMRC data reveals that Inheritance Tax (IHT) receipts for the period April 2021 to February 2022 stood at a whopping £5.5 billion, £700 million higher than the corresponding period in 2021. The average amount paid per estate was around £209,000 and this amount can often be mitigated by various well-accepted financial planning techniques,…

Read articleMeet Our Little Bits of History

Throughout June, Altrincham Town Centre found itself being watched over by 50 life-sized, artistically, designed Corgi statues. As part of the celebrations for the Queens Platinum Jubilee in June 2022, Altrincham BID worked with Inch Arts to create “Trooping the Corgis”. Businesses across the town commissioned artists, schools and community groups to decorate each dog…

Read articleSaving Less Than You Think

One of the biggest worries for new retirees is that they will run out of money. However, there is now evidence that the opposite seems to be happening, retirees are not actually spending enough. Researchers at Texas Tech University stated, “Rather than spending down savings during retirement many studies have found the value of retirees’…

Read articleThe 4% Rule

In 1994, William Bengen published research that revolutionised the financial planning world. He was trying to figure out how much money retirees could withdraw from their portfolio each year without running out of money. Bengen found that retirees throughout history could have withdrawn 4% from an investment portfolio that held 50% in bonds and 50%…

Read articleForesight Wealth Strategists Summer Day Out 2022

On Wednesday, 16th June, the Foresight team went to Alton Towers Resort for a well-deserved Summer day out. The British weather was very kind and the sun shined all-day. Even better, not many others had the same idea, so everyone was able to experience all the rides with very little queuing! In the past we…

Read articleThe Tax Claw is coming

Within this new tax year, which started on 6th April, there are a couple of new ways in which you could potentially pay more tax. National Insurance (NI) is rising, but the threshold at which it starts to be paid will also be raised. NI is set to rise by 1.25% from April and…

Read articleLeave a legacy not a fight

Leaving money to a charity of your choice within your Will is a great way to ensure a positive legacy for the future. It makes the money you worked so hard for during your lifetime continue to do good when you are no longer here. Additionally, if you give at least 10% of your…

Read articleNew Starter

We are pleased to welcome James Allen to the team as our latest Wealth Strategist, to ensure that we are able to maintain and improve our service levels as we continue to grow. James has been working in financial services for 14 years in areas such as mortgages and protection and is looking forward to…

Read articleNew Starter

We are delighted to welcome Kat Thanes to our team as our in-house Marketing Executive. Kat has been with us since April and has been working away behind the scenes. You may have noticed some of the changes she has already implemented and over the next few months many more will appear. Kat’s role with…

Read articleHow can wealth be transferred successfully without destroying the recipient and the wealth itself?

Future planning is a key factor for many people in later life. Having an up-to-date Will is the number one way that people use to communicate their wishes and, although it is an important element, it might not be the most effective way to ensure your children, family or friends get the best outcome from…

Read articleWe are delighted to announce that Platinum SRI Ltd is joining the Foresight Family.

Foresight has continued to grow, even through the pandemic, and the acquisition of Platinum is another step in our ambitious growth plans. Over recent years it has become apparent that the ever-increasing level of regulation and compliance is leading to a smaller number of larger financial advisers, who are able to deal with this overhead…

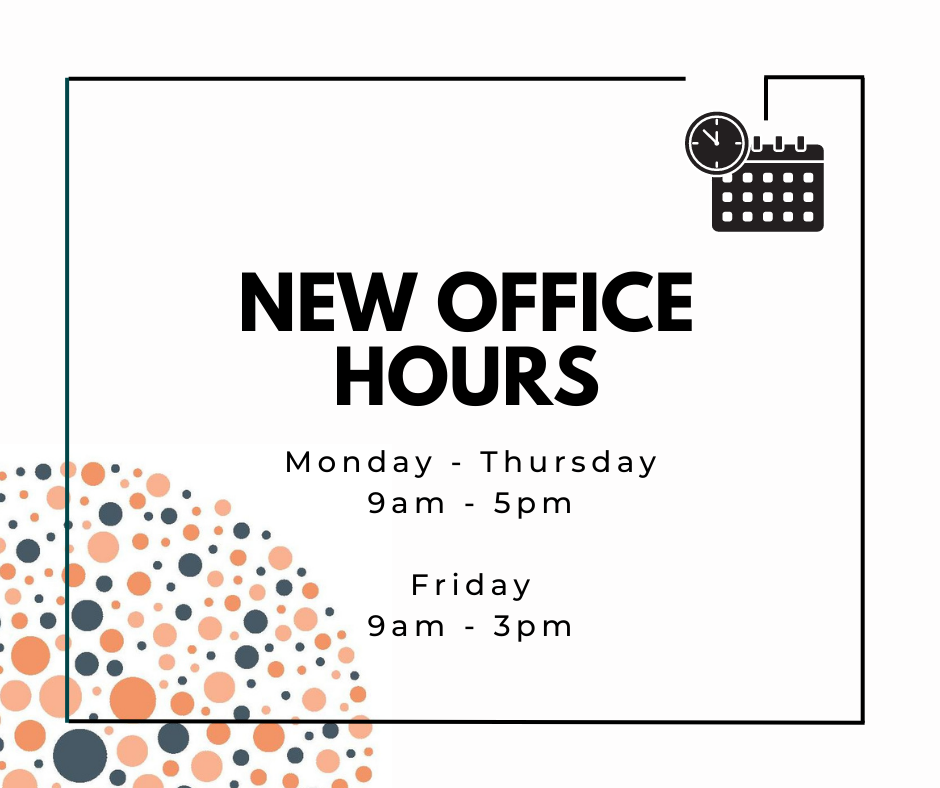

Read articleWe’re making some changes at Foresight

The pandemic has made us all take a step back and reassess how we are working. Having a good work life balance has never been more important. We are really appreciative of our team at Foresight and have already made a number of internal changes to reflect this, such as offering flexible and hybrid working. We…

Read articleThe question is…are you feeling lucky?

With interest rates now the highest they’ve been since the Global Financial Crisis (GFC), are Premium Bonds still worth it? The answer depends on who you ask. With Premium Bonds, it has long been considered that there is no risk to your capital, it is only the ‘interest’ element that is a gamble. And as…

Read articleHMRC calculated that the number of people would increase by 300,000 to 4.6 million people in the 2021/2022 tax year

However, these HMRC estimates were based on Office for Budget Responsibility (OBR) estimates for wage growth from March 2021, which have since changed significantly. Parliament has also frozen current long term tax thresholds, as well as ever-increasing inflation appearing on the scene. HMRC’s estimated number of higher rate taxpayers was based on a 0.9% growth…

Read articleSolidus Award

At Foresight, we always aim to provide the best service for our clients and work hard to maintain these standards. However, it is always good to have outside recognition of our efforts. We are proud to announce that have been awarded the Solidus Achievement of Excellence for our Estate Planning and Trust based solutions. Solidus…

Read articleRishi Sunak – Spring Statement

The Chancellor, Rishi Sunak, has delivered his Spring Statement. Whilst this was originally not intended to be a fiscal event, there were a number of tax announcements. In addition, the Chancellor published a “Tax Plan” for the remainder of the Parliament with a warning that the invasion of Ukraine “presents a risk to our recovery”.…

Read articleWhere there’s a Will, there’s a way to have a family argument

The rise of blended families, where people have multiple marriages and children with different partners, means that the inheritance arena has changed considerably. From the traditional family setup to now including stepparents, stepchildren, divorced parents, and siblings with large age gaps, writing your Will just got a whole lot trickier. Many people assume that their…

Read articleBe A Better Investor

We have already reached the time of year when many New Year’s resolutions have already been broken. However, one resolution that you should have had and should now be a habit is to be a better investor. And that means learning to hold your nerve. Moving forward you want to continue to ignore, as hard…

Read articleUK Graduates Face 49.8% Tax Rate

When the Prime Minister announced that National Insurance rates were to be increased from April to fund the NHS and social care reform, there was a general consensus that the extra funds were a welcome way to improve the NHS. However, the tax rise now means that graduates will face a 49.8% tax charge on…

Read articleA Happy Announcement

We are delighted to announce that Simon Booth, our Managing Director, and Lissa Horton, our Director of Operations, have tied the knot. Simon and Lissa married in mid-January at Chelsea & Kensington Registry Office in London – where all self-respecting rock stars get hitched. They told no one about their secret marriage preparations and even…

Read articleHMRX Nets £254m from Inheritance Tax Investigations

Taxpayers are exempt from Inheritance Tax (IHT) if the value of their estate is below a threshold of £325,000, or £650,000 under a joint allowance, or if the estate is left to a spouse, civil partner, a charity or a community amateur sports club. In the wake of massive pandemic-related spending, HMRC netted £254m in…

Read articleWhat Does Inflation Mean For Me ?

The headline rate for the Consumer Prices Index inflation increased to 5.4% in December, a rise from 5.1% in November, and the highest rate in 30 years. With the Bank of England seeming more hawkish on inflation, interest rates have risen again to 0.5%, at this month’s Monetary Policy Committee meeting. This rise to 0.5%,…

Read articleUse Your ISA Allowance

Individual Savings Accounts (ISA) were introduced over 20 years ago, in the last millennium even, and have always been a very tax-efficient way of investing, with no liability to either Income Tax or Capital Gains Tax on the invested funds. These days ISAs offer the opportunity to invest up to £20,000 annually per person. Unlike…

Read articleMaking Tax Returns Less Taxing

We are firmly within the tax season and, as the 31st of January tax return deadline looms, we thought it would be worth a look at five tax tips to make your life easier. The first one is your Unique Taxpayer Reference (UTR) number. Your UTR number will have been sent to you when you…

Read articleNew Starter

We are pleased to welcome Ben Holland as the latest member of the Foresight team. He joins us as a Client Manager, to help with the ever-increasing workload at Foresight. Ben has previously worked at an IFA practice in Stockport as a Trainee Paraplanner and therefore has a good understanding of what the financial planning…

Read articleWilling Wisdom Update

You might recall that we wrote an article in October last year about our Willing Wisdom campaign to make sure your family knows what you want to happen when you pass away. At Foresight, we are one of a handful of advisers who have acquired the Willing Wisdom Index to help clients plan. The index…

Read articleGetting The Best Returns

The University of John Hopkins recently conducted research into the returns on offer to investors. Between 1900 and 2017, the average annual return on stocks was around 11% and, even after adjusting for inflation, that average annual return only fell to 8%. It shows that, for longer-term investors, staying the course is the best port…

Read articleThe Final Gift

Letting your family know what you want to happen when you pass away is the final gift you can give them. If you are not clear about how you want your money to be split, especially if you have more complex wishes such as uneven distributions, or have stepchildren, then how do you expect your…

Read articleThe cost of a comfortable retirement

The Pensions and Lifetime Savings Association (PLSA) has warned that the cost of retirement has risen substantially – seeing an increase in the cost of 4.9% since 2019. The latest PLSA report predicts an extra £40,000 is needed to fund a comfortable 20-year retirement. They break down their calculations into three tiers – minimum, moderate,…

Read articleBen Dyson gets married…

We are sure that you would like to join us in congratulating Ben Dyson, our Senior Wealth Strategist, on the recent marriage to his very beautiful bride, Sian. Ben and Sian met at their gym 6 years ago, with Sian saying ‘yes’ to Ben’s marriage proposal at the scenic Neuschwanstein Castle in Germany. The castle…

Read articleChanges to Pension Ages

Last year, the Government published a consultation on draft clauses for the Finance Bill 2021-22. Amongst these were clauses that will increase the Normal Minimum Pension Age (“NMPA”) for the purposes of pensions tax. NMPA is the earliest age at which a member’s pension benefits can be taken under a registered pension scheme without higher…

Read articleBudget – Autumn 2021

It has only been six months since the Chancellor last stepped up to the dispatch box to deliver a Budget. Much has changed in that time. Energy price rises, global supply chain issues, and rising demand, prompted by the easing of coronavirus restrictions have caused inflation to hit levels not seen in a decade. With…

Read articleCryptocurrency’s Dictionary corner

Cryptocurrency is the big talking point in finance. Is it the future of finance or a re-incarnation of the Tulip Bubble, the South Sea Bubble, and even the Dotcom bubble rolled into one? Sometimes it feels like complex terms are being used just to confuse people. The world of cryptocurrency revolves around new jargon and…

Read articleStamp Duty Holiday

The Stamp Duty holiday finally ended on 30 September 2021, after being phased out over the summer. The tax break was originally introduced in England in July 2020, as the first national lockdown came to an end, to shore up the housing market. It was split into two phases. Between July 2020 and June 2021 there was no tax to pay…

Read articleThe Bank of Starbucks

Did you know that Starbucks, the humble coffee shop, could well be one of the biggest banks in America? Here is the reason: Next to every till conveniently placed next to the place where you pick up your favourite beverage, is the Starbucks gift card. This card can be topped up with cash to spend…

Read articleDivorce is Never Easy

Divorce is never easy, but it can be far more complicated when you are a business owner. The divorce process is not designed to damage a business. Indeed, the income produced by the business is usually the main source of income and is needed to fund child maintenance and spousal maintenance payments, so damaging the…

Read articleBoris’s Tax Raid Upon Dividends

The Prime Minister has announced a 1.25% increase to dividend tax rates from April 2022 as part of a package of measures to fund the costs of social care and the NHS over the next 3 years. It is estimated that the tax hike will raise about £600 million of additional revenue for the Government.…

Read articleGreenwashing

The scale of the climate change challenge is immense and becoming more apparent each year. If we want to limit global warming to 1.5°C above pre-industrial levels, then global emissions need to fall 7.6% every year this decade. To put this into perspective upon this, the worldwide lockdowns caused by COVID-19 only saw emissions drop…

Read articleBuying into the Cryptocurrency fantasy

Everyone has been talking about it. Cryptocurrency. It has gone mad! Just over a year ago, one Bitcoin was worth just over $10,000. Since then, it has peaked at over $60,000, dropped to nearly $30,000, and, this week, reached a new peak of over $66,000. You can easily be forgiven for feeling like you have…

Read articleInflation – The Silent Killer

Inflation is a silent killer – it earns its’ reputation through the slow deterioration of the purchasing power of your money over time. It is also the enemy of your savings because you always need to take it away from any growth to find out the real rate of return. Low inflation is easily overlooked…

Read articleLong or Short Term Investing?

If you had invested in a UK Index fund from 1980-2009 you would have achieved a return of some 700% on your investment. However, if you had missed just the best 20 days of stock market performance during that period, that return would have been reduced to just 240%. Getting market timing right is a…

Read articleNew team member…

We are delighted to welcome Chris Porter as the latest member of our growing Client Manager team. Chris is coming on board as a Trainee Client Manager, to help deal with our ever-increasing workload Chris has significant financial services experience, having previously worked in Banking and Finance, speciallsing in pension administration for the last 9…

Read articleShould you Pay-off your Grandchildren’s University Debt?

Many people will have come across the headline-grabbing interest rate of 5.6% per annum on some student loans. Many people rightly believe that we should pay off all our debts where possible and should never take out a loan that we know we cannot repay. However, with the average starting salary of graduates stagnant at…

Read articleConsolidating Pensions

Workers nowadays have, on average, 11 jobs during their working lives. So, it is not uncommon to have built up numerous pensions, which are easy to lose track of overtime. Some might be “Defined Benefit”, also known as Final Salary schemes, which promise a certain level of pension from retirement age, while others – increasingly…

Read articleProperty or Pension?

Before we begin any discussion, let us be quite clear – both property and pensions can deliver long-term growth, both can be used to fund retirement, and both can play an important role in savings. In the UK, property has long been seen as a good investment, with house prices beating inflation by 3% per…

Read articleMaking Financial Gifts

Making a gift to your family and friends while you are alive can be a good way to reduce the value of your estate for Inheritance Tax purposes, ensuring those closest to you benefit from a lifetime of your hard work. Estate and tax planning is a complex area and professional financial advice can help…

Read articleAre get rich schemes worth the risk?

There are many reasons to look at so-called “get rich schemes” during the current climate. We are only just coming out of a national lockdown and the future of the UK economy looks bleak with short-term inflation and recession fears to name but a few. Many people have had more time on their hands, and…

Read articleThe Impact of The Lifetime Allowance

The Spring Budget announced that the Pension Life Time Allowance (LTA) would be frozen until at least April 2026 at £1,073,100. Previously, the LTA increased at the target rate of 2.5% however last year due to the low inflationary environment, it only went up by 0.5%. A prolonged period with no inflationary increases will mean…

Read articleLongevity Risk

One of the most fundamental risks in retirement is longevity, the risk of running out of money before running out of life. Whilst there are a lot of benefits to living a long time, longevity undoubtedly increases financial risk. So just how long will your retirement plan need to generate income? Most people underestimate their life expectancy, often significantly. A man who is 65 years…

Read articleCashflow Forecasting – Better than a Crystal Ball

A client once remarked that it would be good if we had a crystal ball for their finances. A good point well made, so we went and bought one from Amazon, which still sits on a windowsill in the office. It looks good but has never proved to be entirely reliable. Cashflow forecasting, on the…

Read articleProbate is getting easier…

Each year around 25,000 estates in the UK have to pay Inheritance Tax (IHT), but a further 250,000 also have to jump through onerous and time-consuming hoops to establish that they do not. The job of gathering every last detail of a friend or relative’s financial affairs, requiring as many as 25 different forms to be completed, is a real labour of love. However,…

Read articleDivorce and Collabortive law

The pandemic has been a very difficult time for everyone, and one of the fallouts is going to be an increased divorce rate as many people re-evaluate their lives. Even Bill Gates, once the world’s richest man, said that he and his wife Melinda were not going to be able to grow old together. Indeed,…

Read articleIs my children’s inheritance protected if I remarry?

It is a sombre thought to think about what happens to your family once you are gone, or what happens should your spouse pass away prematurely. However, with increasing life expectancy, many more are shunning widowhood and are instead searching for a new partner with which to enjoy a later-life romance. Marriage rates for over-65s…

Read articleAre you covered? – Cyber Insurance

You might have read in the news a couple of weeks ago that between 800 and 1,500 businesses around the world were affected by a ransomware attack centred on US IT firm Kaseya, a company that provides software tools to IT outsourcing shops. The most notable disruption occurred in Sweden, where hundreds of Co-Op supermarkets had…

Read articleNo desire to retire generation

Retirement might mean stopping the 9-to-5, but it does not have to mean giving up on work these days. With many people gaining the taste for flexible working during the pandemic, the freedom to work how and when you like suits those who may have caring responsibilities or even health issues, whilst giving those considering…

Read articleWills are not just for old people

“I’ll do them when I am older.” If I had a pound for every time that I had heard that phrase when asking about Wills, then I would be significantly more wealthy. Unfortunately, as we all know, there are only 2 certainties in life – and suddenly taxes seem the more appealing. As the pandemic…

Read articleInvestment Update – April 2021

A year has passed since the World Health Organisation (WHO) declared COVID-19 a pandemic. In the year since, tremendous effort has been expended to stop the spread of the virus, and protect people and economies. Whereas this time last year, equity markets were falling sharply, and corporate bond spreads were widening dramatically, many equity indices…

Read articleWhat is your number?

Some people dream about retirement, others plan assiduously for it, and for others, it just comes along. Retirement means many things for different people but knowing when you can afford to go depends on your number – the level of assets that you need to be certain that you do not need to return to…

Read articleNew Team Member

We are delighted to welcome Freddie Barton as the newest member of the Foresight team. He will be coming on board as a Trainee Client Manager, to help with the ever-increasing workload at Foresight. Freddie has previously worked at another practice as a Trainee Paraplanner and therefore already has a good understanding of what the…

Read articleFinancial Planning in your 60’s

By the time you reach your 60s, you should already have covered the basics of financial planning: ISAs, Pensions, Wills and even Trust planning. So, what are the next steps as you move towards the end of your working life and into retirement? For many people, actioning their financial plan can be a mentally difficult…

Read articleISA Allowance 2020/2021

Individual Savings Accounts (ISAs) offer the opportunity to invest up to £20,000 annually. ISAs are a tax-efficient way of investing, with no liability to either Income Tax or Capital Gains Tax on the invested funds. Unlike pension allowances, the ISA allowance cannot be reclaimed from previous years. Therefore, if you are intending to utilise this…

Read articleThe Stealth Tax Trap

The bill for COVID is coming, make no mistake about it. Yet, in a clever game of political smoke and mirrors, Chancellor of the Exchequer Rishi Sunak served up some hope in the Budget, freezing personal and corporation tax bands rather than increasing tax rates as originally mooted. All seems to be well until you…

Read articleEstate Planning – working with Professional connections.

At Foresight, we like to think that we are experts in what we do – financial planning. However, one of the most important things to know as a professional is not only where your expertise starts but, even more importantly, where it ends. This is why we have a network of trusted professional connections in…

Read articleLearn to enjoy your money

As a Wealth Strategist, one of the things that you learn at a very early point is that it is not the amount of money you have that makes you happy, it’s what you do with it that gives the enjoyment. And, although the richest clients are not necessarily the happiest, it is also true…

Read articleLasting Power of Attorneys

Lasting Powers of Attorney (LPAs) allow you to appoint an individual to act as your legal representative in the event of declining mental health or injury. Whilst LPAs are vitally important documents and critical to your financial planning, it is estimated that less than 1% of the British public have one. In contrast, 40% of…

Read articleA New Team Member

We are pleased to welcome Callum Robinson as a new member of the Client Manager team. He will be coming on board as a Trainee Client Manager, to help deal with the ever-increasing workload at Foresight. Callum has previously worked in the Hospitality Industry as a Manager and therefore has a great understanding of customer…

Read articleBusiness Exit Strategy – What’s Your’s?

An exit strategy is something that every owner of a small business looks for. Even a one-person business still needs an exit strategy. The main questions that need to be answered are; how are you going to get your money out of the business and how much money are you going to get? Having an…

Read articleWhat motivates a successful entrepreneur?

Entrepreneur noun 1. a person who sets up a business or businesses, taking on financial risks in the hope of profit. As George W Bush once allegedly said when discussing the decline of the French economy. “The problem with the French is that they don’t have a word for entrepreneur.” No one gets to the…

Read articleReasons Why You Need A Shareholder Agreement

When businesses are set up initially, it is often done in a fuzzy haze of optimism, blind faith, and self-belief. However, further down the line, a healthy dose of realism needs to be injected into the heady mix. In this article, we explore what happens if one of the owners dies, and how to protect…

Read articleProfessional Adviser Awards Finalists 2021

We are pleased to announce that Foresight is once again a Finalist in the Professional Adviser ‘Adviser of the Year Firm’ Awards 2021. These seek to reward excellence and are one of the most prestigious in the financial planning profession, with over 200 advisers, firms, and providers being considered for the 2021 awards. Foresight has…

Read articleInvestment Update – January 2021

Past experience has taught us that market environments that feature cheap financing, easy access to investments, the incentive to engage in speculative activity, and a technological or political “spark” tend to lead to bubbles. Bond prices are so elevated that a quarter of all global bonds are trading with negative interest rates. Tesla now has…

Read articleThinking of selling your business? – what you need to know

There are likely to be many long-term changes as a result of the current pandemic. Many people will be taking a long, hard look at their pre-COVID existences and starting to consider what is really important in life. The idea of selling the family business and sailing off into the sunset might well be a…

Read articleNew ISA rules now allow for a …. CADI

The rules have now changed on how ISAs can be passed on to spouses and civil partners upon death. These rules now allow for a Continuing Account of a Deceased Investor (CADI), which improves the rules on Additional Permitted Subscriptions (APS). The process of inheriting these assets is now simpler and more tax-efficient, meaning fewer…

Read articleDon’t rely on your assets if things go wrong

“Asset rich, but cash poor” – it is a problem that many face in retirement. But exactly what does it mean? Assets are wealth that you own, whereas cash is money that can be spent without selling anything first. The last part of that definition is crucial and the reason why many people suffer a decrease in their standard of living when moving…

Read articleWill the tax man inherit your Assets?

You have worked hard all your life, built up substantial assets, and simply want to pass these down to your children and grandchildren to give them a helping hand in life once you have gone. It is a common goal we hear when speaking with clients. However, as with many things in life, it is…

Read articleFinancial Planning in your 50’s

If you are still working in your 50’s then this is the perfect time to make sure your retirement savings are on track to provide you with your desired lifestyle. It is never too late to consider financial planning and being over 50 comes with some significant advantages, namely the benefit of having a better…

Read articleWhat’s the difference between an Independent Adviser and a Restricted Adviser?

For a number of years, all financial advisers have had to disclose whether they are independent or not, but what exactly does this mean? Whether your adviser offers independent or restricted advice can have a big impact on the type and range of advice they can offer. Independent advice is based on whole of…

Read articleWhy investing your money is more profitable than leaving it in the bank…

Holding cash on deposit is a necessary part of the financial planning process. There are always unexpected twists and turns that life throws at us, so the general rule of thumb is to have two to three months’ living expenses saved in an instant access account, just in case. Is Cash King? When it comes…

Read articleWe are hiring…

We are delighted to say that, due to our continued expansion, we are looking to recruit four additional team members – two Client Managers (what other people call Paraplanners) and two Trainee Client Managers to join our dynamic and forward-thinking team. We have ambitious plans, and these can only be achieved by recruiting the right…

Read articleResurgence of Bitcoin

Bitcoin has proven to be a phenomenon of the modern financial system that will just not go away. Despite a rollercoaster ride for speculators and holders of the alternative currency, interest in Bitcoin and other cryptocurrencies is again reaching record highs. Bitcoin, along with a range of other cryptocurrencies, have emerged in the last few years with proponents proclaiming…

Read articleWhat do I need my business to be worth?

Business owners spend years, sometimes decades, building their business. Yet when it comes to selling their business, many often do it without any real thought about what they really need and the effect upon them and their family. The day-to-day pressures of running a business often means that personal financial planning drops to the bottom…

Read articleESG and Greenwashing

Over the past few years, there has been a growing demand from investors who not only want investment growth but also want to see the companies and funds they invest in providing benefit to the environment and communities. Known as ESG – Environmental, Social, and corporate Governance – the market is awash with claims of ESG friendly investments. In fact, the sector has been one of the fastest-growing, and this trend has accelerated dramatically during…

Read articleHow much do I need for a comfortable retirement?

On average, in retirement, most households spend around £2,110 per month. Many people overestimate how much they will need in retirement by assuming they will spend the same as they currently earn. This is because they fail to appreciate the reduction in expenses that comes as you get older. The mortgage is often nearly paid,…

Read articleDoes your family talk about money?

The average age for a UK adult to become a parent is 29.8 years old. By this point, most people should have at least a basic understanding of how to look after their finances. They should be contributing to a pension. Some will be diligently saving into ISAs in the hope of becoming an “ISA…

Read articleFinancial Planning in your 40’s

Finances play a critical role in life throughout. Many decisions are dictated by the state of our finances, so having good financial planning is one of the most effective tools in achieving the life that you truly want. As we go through life our lifestyles and priorities shift and so do our financial planning requirements. …

Read articleGrowing the Culture at Foresight

Working from home and keeping the team culture alive can be difficult during these COVID-19 times. But, we have worked hard to make sure we continue in the same way we did in the office. Part of this has been to keep up the element of team fun and we have found Zoom fantastic for…

Read articleFinancial planning in your 30’s

By the time you get to your 30’s, you are probably starting to realise where your career is going, and how things are going to pan out from a financial point of view. It’s a time where your parent’s words that you would never have as much money as you had in your 20’s suddenly has…

Read articleMarket Prospects for a Biden Presidency

The US election was, as many predicted, a hard-fought election. Although the coronavirus pandemic was a key issue for both sides, the election was characterised by the overt populist support that Trump enjoyed and played out through his large rallies, and the more mainstream support for Biden. Although the result of the election has not been formally announced and President Trump has not yet formally conceded, we now expect…

Read articleThe Real Value of Advice

When times are good and confidence is high, pretty much anybody should be able to generate reasonable returns. However, in turbulent times such as these, having the support of a trusted adviser who you can rely upon to help, advise and guide you can really start to pay dividends. We see many people who have…

Read articleFinancial Planning in your 20’s

Financial planning is all about setting plans and expectations. Imagine you’re starting a business. A business plan is essential in order to acquire funding, renting office space, and generally getting started. Most of us learned this by the time we were sat in GCSE Business Studies and perhaps we have even had experience writing one. However, so many people don’t follow this for their…

Read articleWill you or won’t you – die without a Will?

Wills. Something that we put to the back of our minds. Something to sort out later on when you are old and grey. As it has been said, the only certainties in life are death and taxes – and a certain Mr. Trump has shown that even taxes may be optional. So, we get back…

Read articleUS Election 2020 – Preview

2020 has already turned out to be a year for the record books for all the wrong reasons, with the coronavirus pandemic and global shutdown making most of the headline news. However, despite the end of the year being near, 2020 still has a few tricks up its’ sleeve. Chief amongst these is the US Presidential…

Read articleForesight has it’s very own star!

We are very proud to announce that Ben Dyson, one of our Wealth Strategists, has become the Personal Finance Society’s youngest fellowship graduate in 2020. The Personal Finance Society is part of the Chartered Insurance Institute, the most prestigious recognised body for financial services professionals and Ben’s achievements place him right at the top of…

Read articleAn Article of Little Interest

National Savings and Investments (NS&I) announced at the end of September that they would be drastically cutting their interest rates to as low as 0.01% per annum. This has left many cash savers scrambling to the private banks still offering accounts rates above 1%. However, with the river of new money in the form of…

Read articleAvoiding IHT doesn’t mean rushing to tie the knot

Currently, there are around 3.3 million unmarried cohabiting couples in the UK. Yet most legislation focuses mainly upon protecting married couples when it comes to estate planning, meaning that many cohabiting couples face large Inheritance Tax (IHT) charges on both first and second death. This is because unmarried couples do not benefit from spousal exemptions…

Read articleInvestment Update – September 2020

Around the world, economies have re-opened with a degree of reservation. However, since August many countries have faced a resurgence in coronavirus cases, prompting concerns that a ‘second wave’ is already underway. Several European countries have witnessed a spike in coronavirus cases including France, Spain, Belgium, and Luxembourg. Even once ‘safe’ countries such as Denmark & Iceland have been…

Read articleSocially Responsible Investing

Traditionally, investment decisions have been made using standard methodology. A balanced portfolio should have a diversified asset allocation with elements of equity, fixed interest, and cash. But, until recently, there has been little thought as to the underlying companies and, more importantly, how companies use the invested money. But there is now an ever-increasing movement…

Read articleRetirement could be further away than you think

The age that savers will be able to access their pensions will rise from 55 to 57 in 2028. The Government wants to delay the age savers can access their private pensions to keep it in line with the state pension age, which is also scheduled to rise to 67 in 2028. The logic behind…

Read articleInvestment Update – August 2020

Stock prices started the month strongly thanks to good early results from COVID-19 vaccine trials, better-than-expected employment reports, and higher-than-anticipated manufacturing activity. In the US, despite multiple States reporting increased COVID infections, stocks continued to climb, especially in large technology. American indices are now back in positive territory for the current year. These behemoth companies,…

Read articleRecession

During 2020 the world economy shifted from a position of strong growth to severe global recession. Although this is clearly a significant concern, recessions are a normal part of the economic cycle so it is important to look at this in the right context to understand what is occurring now and what might happen next.…

Read articleCoronavirus Economic Impact

The UK has been in lockdown since March 2020 as part of the measures to mitigate the impact of COVID-19 across British society. Countries around the world have adopted a variety of strategies with many across Europe following a similar stance. This strategy was put in place following the alarming figures coming out of China…

Read articleThe Ultimate Guide for Making Your Will